Global Decorative Laminates Market Size, Share, Growth Analysis Report - Forecast 2034

Decorative Laminates Market By Type (High-Pressure Laminates, Low-Pressure Laminates), By Application (Furniture & Cabinets, Flooring, Wall Panels), By Raw Material (Plastic Resin, Overlays, Adhesives, Kraft Paper, Decor Paper), By End-user (Residential, Commercial), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 48.52 Billion | USD 84.47 Billion | 5.7% | 2024 |

Decorative Laminates Industry Perspective:

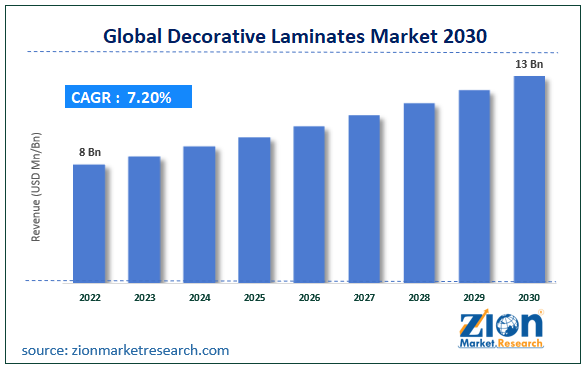

The global decorative laminates market size was worth around USD 48.52 Billion in 2024 and is predicted to grow to around USD 84.47 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.7% between 2025 and 2034. The report analyzes the global decorative laminates market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the decorative laminates industry.

Decorative Laminates Market: Overview

Decorative laminates are sheet laminates of decorative printed papers as well as brown Kraft papers combined by using heat as well as pressure. These products offer protection to furniture from corrosion, fire, and scratches. They are also utilized in wall paneling and furniture surface substances. These products demonstrate anti-fungal and anti-bacterial features and are highly resistant to stains as well as moisture. Apparently, they help in enhancing the lifespan of any surfaces and impart an attractive finishing touch to them. Utilization of decorative laminates imparts an exceptional & stylish look to the furniture in residential & non-residential sectors.

Key Insights

- As per the analysis shared by our research analyst, the global decorative laminates market is estimated to grow annually at a CAGR of around 5.7% over the forecast period (2025-2034).

- Regarding revenue, the global decorative laminates market size was valued at around USD 48.52 Billion in 2024 and is projected to reach USD 84.47 Billion by 2034.

- The decorative laminates market is projected to grow at a significant rate due to Increasing use in furniture, flooring, and interior design drives demand. Growth in real estate and renovations also supports market expansion.

- Based on Type, the High-Pressure Laminates segment is expected to lead the global market.

- On the basis of Application, the Furniture & Cabinets segment is growing at a high rate and will continue to dominate the global market.

- Based on the Raw Material, the Plastic Resin segment is projected to swipe the largest market share.

- By End-user, the Residential segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Decorative Laminates Market: Growth Factors

Rise in the penetration of products in the construction sector to boost global market trends

The rapidly expanding construction sector and enhancement in living standards will prompt the expansion of the decorative laminates market over the estimated timespan. In addition to this, low deployment costs as well as the reduction in maintenance costs of the product will embellish the global market trends. Technological breakthroughs in texture & printing procedures proliferate the global market size in the years ahead. Furthermore, massive product demand in flooring activities along with altering fashion trends will steer the expansion of the market over the forecast timespan.

Additionally, growing artistic developments and the launching of new designs & patterns on metal surfaces, wood, ceramics, natural tiles, and gloss as well as 3D surfaces will escalate the expansion of the market in the forthcoming years. Strategic alliances and capacity expansions are predicted to make notable contributions toward the global market proceeds in the near future. For instance, in the last quarter of 2021, Wilsonart, a key manufacturer and distributor of decorative laminates, increased its production capacity by establishing a new unit in Oregon in the U.S. Furthermore, in the first half of 2022, Panolam Industries International Inc., a key player producing high-pressure laminates & thermally-fused laminates, signed an agreement with Specialty Laminates, a key manufacturer of thermally-fused laminates, for expanding thermally fused laminates product line of both firms.

Decorative Laminates Market: Restraints

High product costs can hamper the expansion of the global industry over 2025-2034

Rising product costs will put brakes on the global decorative laminates industry growth over the ensuing years. Fluctuating raw component prices are likely to impede the total sales of the product in the upcoming years.

Decorative Laminates Market: Opportunities

Low maintenance costs can create new growth opportunities for the global market

Elongated shelf life along with high heat resistance, moisture resistance, and abrasion resistance is projected to open new growth avenues for the global decorative laminates market. Moreover, lower maintenance charges and reduction in deployment costs will further pave the way for the global market surge in the upcoming years.

Decorative Laminates Market: Challenges

Stringent legislation executed by the government pertaining to product usage can prove to be a huge challenge for the global industry

Strict laws implemented by the government related to the use of the product can prove to be a big challenge in the growth path of the global decorative laminates industry in the years to come.

Decorative Laminates Market: Segmentation

The global decorative laminates market is sectored into raw material, end-use sector, application, type, and region.

In type terms, the global decorative laminates market is segregated into low-pressure laminates and high-pressure laminates segments. Furthermore, the high-pressure laminates segment, which acquired approximately 58% of the global market revenue in 2024, is anticipated to register the highest growth rate in the next eight years. The growth of the segment during the projected timespan can be attributed to a rise in the penetration of high-pressure decorative laminates in construction activities.

Based on the application, the global decorative laminates industry is sectored into cabinets & furniture, flooring, tabletop, countertop, and wall panels segments. Moreover, the cabinets & furniture segment, which accumulated the largest share of the global industry in 2024, is anticipated to lead the segmental landscape in the next couple of years. The expansion of the segment in the ensuing years can be subject to a rise in the use of decorative laminates in cabinets & furniture production to enhance the durability and longevity of the latte r.

Based on the raw material, the decorative laminates market globally is bifurcated into plastic resins, overlays, adhesives, and wood substrate segments.

Based on the end-use sector, the global decorative laminates industry is divided into non-residential, residential, and transportation segments.

Decorative Laminates Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Decorative Laminates Market |

| Market Size in 2024 | USD 48.52 Billion |

| Market Forecast in 2034 | USD 84.47 Billion |

| Growth Rate | CAGR of 5.7% |

| Number of Pages | 210 |

| Key Companies Covered | Wilsonart International Inc., Greenlam Industries Limited, Stylam Industries Limited, Omnova Solutions Incorporation, Panolam Industries International Inc., Fletcher Building Limited, Archidply Industries Limited, Merino Group, Laminati S.p.A., FunderMax Gmbh, and others., and others. |

| Segments Covered | By Type, By Application, By Raw Material, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Decorative Laminates Market: Regional Insights

North America is predicted to maintain its dominant position in the global decorative laminates market over the prognosis timeframe

North America, which amassed approximately 55% of the global decorative laminates market revenue share in 2022, is predicted to dominate the regional sphere in the upcoming years. Additionally, the regional market expansion over the coming eight years can be attributed to the rise in the demand for decorative laminates in bathroom components and the construction of panels in buildings. Apart from this, the presence of key players in countries such as the U.S. and Canada will proliferate the growth of the market in the region.

The Asia-Pacific decorative laminates industry is set to register the highest CAGR in the ensuing years subject to favorable government schemes about the use of products implemented in the countries such as India and China. Apart from this, a high focus of the respective governments on bringing a paradigm shift in infrastructural growth will further define the growth of the industry in the sub-continent.

Decorative Laminates Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the decorative laminates market on a global and regional basis.

The global decorative laminates market is dominated by players like:

- Wilsonart International Inc.

- Greenlam Industries Limited

- Stylam Industries Limited

- Omnova Solutions Incorporation

- Panolam Industries International Inc.

- Fletcher Building Limited

- Archidply Industries Limited

- Merino Group

- Laminati S.p.A.

- FunderMax Gmbh

- and others.

The global decorative laminates market is segmented as follows;

By Type

- High-Pressure Laminates

- Low-Pressure Laminates

By Application

- Furniture & Cabinets

- Flooring

- Wall Panels

By Raw Material

- Plastic Resin

- Overlays

- Adhesives

- Kraft Paper

- Decor Paper

By End-user

- Residential

- Commercial

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Decorative laminates are sheet laminates of decorative printed papers as well as brown Kraft papers combined by using heat as well as pressure. These products offer protection to furniture from corrosion, fire, and scratches.

The global decorative laminates market is expected to grow due to Increasing use in furniture, flooring, and interior design drives demand. Growth in real estate and renovations also supports market expansion.

According to a study, the global decorative laminates market size was worth around USD 48.52 Billion in 2024 and is expected to reach USD 84.47 Billion by 2034.

The global decorative laminates market is expected to grow at a CAGR of 5.7% during the forecast period.

Asia-Pacific is expected to dominate the decorative laminates market over the forecast period.

Leading players in the global decorative laminates market include Wilsonart International Inc., Greenlam Industries Limited, Stylam Industries Limited, Omnova Solutions Incorporation, Panolam Industries International Inc., Fletcher Building Limited, Archidply Industries Limited, Merino Group, Laminati S.p.A., FunderMax Gmbh, and others., among others.

The report explores crucial aspects of the decorative laminates market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed