Comprehensive Metabolic Panel Testing Market Size, Share, Trends, Growth 2034

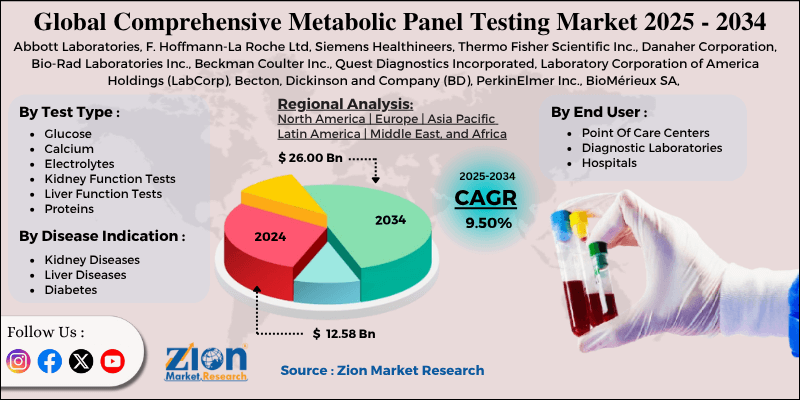

Comprehensive Metabolic Panel Testing Market By Test Type (Glucose, Calcium, Electrolytes, Kidney Function Tests, Liver Function Tests, Proteins), By Disease Indication (Kidney Diseases, Liver Diseases, Diabetes, and Others), By End-User (Point Of Care Centers, Diagnostic Laboratories, Hospitals, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

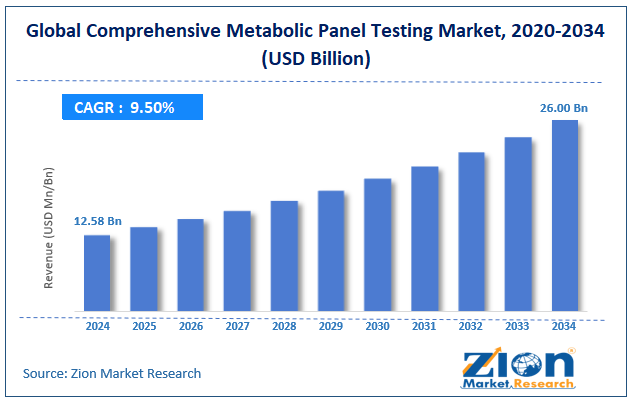

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.58 Billion | USD 26.00 Billion | 9.50% | 2024 |

Comprehensive Metabolic Panel Testing Industry Perspective:

The global comprehensive metabolic panel testing market size was approximately USD 12.58 billion in 2024 and is projected to reach around USD 26.00 billion by 2034, with a compound annual growth rate (CAGR) of approximately 9.50% between 2025 and 2034.

Comprehensive Metabolic Panel Testing Market: Overview

A comprehensive metabolic panel test is a routine blood test that provides crucial information on the body's metabolism and potential chemical imbalances. It measures 14 different elements in the blood, including calcium, glucose, kidney function, liver function, and electrolytes. These tests are primarily used for diagnosing conditions such as liver disease, diabetes, and kidney disorders, as well as for monitoring ongoing treatment and overall health status.

The key drivers of the comprehensive metabolic panel testing market include the rising incidence of chronic diseases globally, increased awareness of preventive health measures, and advancements in laboratory testing.

The increasing cases of chronic diseases like kidney disease, liver disorders, and diabetes are notably impacting the CMP test demand. These conditions need repetitive metabolic monitoring for efficient disease management. CMP testing provides an exhaustive evaluation that facilitates monitoring and early detection of potential issues.

Moreover, rising awareness of preventive healthcare is motivating individuals to undergo regular health checkups. CMP testing is a vital part of routine health screenings in several economies. This move towards proactive health monitoring is surging test volumes.

Additionally, advancements in automated analyzers, digital reporting, and laboratory automation have improved accuracy, test speed, and scalability. This modernization enables laboratories to process higher quantities of testing effectively. Better turnaround times improve adoption in healthcare settings.

Nevertheless, the global market may experience sluggish growth due to the high cost of advanced testing equipment and a lack of awareness in developing countries. Modern lab infrastructure and automated analyzers needed for CMP testing may not be affordable.

Underfunded health systems and smaller clinics in developing regions may find this adoption challenging. This restricts the industry penetration in resource-limited areas. In several developing regions, awareness of routine testing and metabolic health remains low. Individuals usually seek healthcare only during acute illnesses. This reactive approach controls the routine use of comprehensive metabolic panels.

Nonetheless, the global comprehensive metabolic panel testing industry is poised to benefit from remote diagnostics, home sample collection, and integration with predictive analytics and AI. The emergence of telehealth and at-home diagnostics has increased the accessibility of CMP testing. Home sample collection facilities enable routine testing without the need to visit clinics. This convenience factor is propelling the industry among urban users.

Also, AI analytics helps to interpret CMP data for predictive health modeling. These tools enhance early diagnosis. Blending CMP with artificial intelligence platforms improves the clinical value of tests.

Key Insights:

- As per the analysis shared by our research analyst, the global comprehensive metabolic panel testing market is estimated to grow annually at a CAGR of around 9.50% over the forecast period (2025-2034)

- In terms of revenue, the global comprehensive metabolic panel testing market size was valued at around USD 12.58 billion in 2024 and is projected to reach USD 26.00 billion by 2034.

- The comprehensive metabolic panel testing market is projected to grow significantly due to the surging cases of chronic diseases, the rise in ambulatory care services and outpatient care, and the increasing demand for preventive testing.

- Based on test type, the glucose segment is expected to lead the market, while the liver function tests segment is expected to grow considerably.

- Based on disease indication, the diabetes segment is the largest, while the liver diseases segment is projected to witness substantial revenue growth over the forecast period.

- Based on end-user, the hospitals segment is expected to lead the market compared to the diagnostic laboratories segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Comprehensive Metabolic Panel Testing Market: Growth Drivers

Rising adoption of wellness testing and preventive healthcare propels the market growth

The standard inclination towards wellness screening and preventive health management is one of the leading growth drivers in the comprehensive metabolic panel testing market. Consumers are increasingly opting for regular health screenings to detect diseases early and adopting medications promptly. CMP tests are vital to these checkups, as they evaluate crucial parameters such as electrolytes, kidney function, liver enzymes, and glucose levels.

Moreover, the rise in health insurance programs for preventive testing and corporate wellness has elevated the incorporation of CMP tests in routine health check packages.

Growth of diagnostic infrastructure in developing regions spurs market growth

Emerging markets in Latin America, the Asia Pacific, and Africa are experiencing rapid growth in diagnostic infrastructure, driven by foreign investments, public-private partnerships, and health reforms. Despite CMP testing being an informative and cost-efficient panel, it is among the primary services launched in community health programs and new diagnostic labs.

In Africa, nations such as South Africa, Nigeria, and Kenya have adopted national essential diagnostics lists, also known as EDLs, which comprise CMP tests as a standard part. This infrastructural growth, along with increasing health awareness, is driving the demand for routine metabolic panel tests in low-income and developing regions.

Comprehensive Metabolic Panel Testing Market: Restraints

Varying reimbursement policies across regions negatively impact market progress

One of the key barriers in the CMP testing market is the scarcity of standardized reimbursement policies, especially in the emerging and middle-income regions. While nations like Germany, the United States, and Japan offer insurance coverage or Medicare for CMP tests, many economies either remove these tests or offer partial reimbursement, restricting affordability for people.

For example, a 2024 OECD Health Policy Review disclosed that only 37 percent of middle-income and low-income nations reimburse routine biochemical panels, which include comprehensive metabolic panels.

Comprehensive Metabolic Panel Testing Market: Opportunities

Preventive healthcare campaigns and government-led screening initiatives impel the industry's growth

Many nations are now adopting national checkup programs that comprise comprehensive metabolic panel testing to control the rising pressure of NCDs (non-communicable diseases). These efforts are dedicated to identifying abnormalities in electrolytes, glucose, and kidney-liver markers early, thus reducing long-term hospital costs and hospitalization rates. This notably impacts the progress of the comprehensive metabolic panel testing industry.

Comprehensive Metabolic Panel Testing Market: Challenges

Limited integration with POCT (Point-of-Care Testing) devices restricts the market growth

Although POC testing is progressing at a rapid pace, mainly in emergency and rural settings, CMPs are still fundamentally processed in centralized laboratories because of their complexity. Most POC testing devices support limited or single-parameter tests, such as creatinine or glucose, rather than complete 14-parameter CMPs.

According to the 2024 Kalorama report, less than 6% of CMPs on a global scale are conducted through POCT-compatible platforms, highlighting the scarcity of accurate and miniaturized technology for comprehensive blood chemistry studies in decentralized settings. This restricts industry penetration in underserved or remote regions.

Comprehensive Metabolic Panel Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Comprehensive Metabolic Panel Testing Market |

| Market Size in 2024 | USD 12.58 Billion |

| Market Forecast in 2034 | USD 26.00 Billion |

| Growth Rate | CAGR of 9.50% |

| Number of Pages | 214 |

| Key Companies Covered | Abbott Laboratories, F. Hoffmann-La Roche Ltd, Siemens Healthineers, Thermo Fisher Scientific Inc., Danaher Corporation, Bio-Rad Laboratories Inc., Beckman Coulter Inc., Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (LabCorp), Becton, Dickinson and Company (BD), PerkinElmer Inc., BioMérieux SA, Ortho Clinical Diagnostics, Randox Laboratories Ltd., Nova Biomedical, and others. |

| Segments Covered | By Test Type, By Disease Indication, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Comprehensive Metabolic Panel Testing Market: Segmentation

The global comprehensive metabolic panel testing market is segmented based on test type, disease indication, end-user, and region.

Based on test type, the global comprehensive metabolic panel testing industry is divided into glucose, calcium, electrolytes, kidney function tests, liver function tests, and proteins. The glucose segment registered a substantial growth backed by the rising cases of metabolic syndrome and diabetes. CMPs usually comprise fasting blood glucose measurements, which are routinely used to monitor and diagnose diabetes. The test is quick, simple, and highly standardized, which contributes to its broader adoption in clinics, hospitals, and diagnostic laboratories.

Based on disease indication, the global comprehensive metabolic panel testing market is segmented into kidney diseases, liver diseases, diabetes, and others. The diabetes segment captured a remarkable share of the market due to its broader prevalence and the need for consistent metabolic tracking. CMPs help evaluate electrolyte imbalances and glucose levels, which are often associated with diabetes, thereby increasing their importance in diabetes management and treatment. Physicians usually opt for CMPs to check for diabetes and monitor complications like liver stress or kidney dysfunction. Hence, this high frequency increases the segmental dominance.

Based on end-user, the global market is segmented into point of care centers, diagnostic laboratories, hospitals, and others. Hospitals are the leading end-use segments due to their key role in emergency care, patient diagnosis, and inpatient monitoring. CMP panels are broadly used in UCUs, emergency rooms, and preoperative settings to evaluate electrolyte balance, organ function, and metabolic health status. With extensive and complex care needs and patient volumes, hospitals are heavily dependent on CMP tests for the management of both chronic and acute diseases.

Comprehensive Metabolic Panel Testing Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is expected to continue its leadership in the comprehensive metabolic panel testing market over the coming years, owing to its advanced healthcare infrastructure, expanding home diagnostics services and telehealth, and technological improvements and laboratory automation. The region boasts a well-established healthcare system with broader access to diagnostic labs and hospital testing. This infrastructure allows routine use of comprehensive metabolic tests in healthcare settings.

The growth of home sample collection services and telemedicine after the COVID-19 pandemic has increased the accessibility of tests. Prominent labs, such as Quest Diagnostics and LabCorp, offer at-home test services in North America. This inclination widens user reach beyond conventional lab and hospital settings.

Moreover, the region leads in the adoption of next-generation diagnostic solutions, including fully automated analyzers and AI-based laboratory systems. These modernizations enhance accuracy and decrease turnaround times for comprehensive metabolic panel tests. The region’s advancement in infrastructure notably improves testing scalability and efficiency.

The Asia Pacific is expected to experience considerable growth in the comprehensive metabolic panel testing industry over the forecast period, driven by a rapid rise in chronic illnesses, expanding healthcare infrastructure, and increasing preventive testing and health awareness. Asia Pacific is seeing a remarkable growth in lifestyle-associated diseases like hypertension, liver illnesses, and diabetes. These growing numbers are fueling the broader demand for routine CMP tests to track metabolic health.

Additionally, nations such as Indonesia, China, and India are investing in the development of their healthcare infrastructure. Hence, access to comprehensive testing is gaining prominence rapidly, particularly in semi-urban and urban areas.

Additionally, digital health initiatives and awareness campaigns have significantly increased preventive health screenings in the region. Consumers are now more actively seeking regular health examinations.

Comprehensive Metabolic Panel Testing Market: Competitive Analysis

The key operating players in the global comprehensive metabolic panel testing market are:

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Siemens Healthineers

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Bio-Rad Laboratories Inc.

- Beckman Coulter Inc.

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (LabCorp)

- Becton

- Dickinson and Company (BD)

- PerkinElmer Inc.

- BioMérieux SA

- Ortho Clinical Diagnostics

- Randox Laboratories Ltd.

- Nova Biomedical

Comprehensive Metabolic Panel Testing Market: Key Market Trends

Surging demand for remote and at-home sample collection:

The inclination towards patient-centric care has notably increased the adoption of home sample collection for comprehensive metabolic panel testing. Leading companies, such as Thyrocare and LabCorp, offer door-to-door testing services, primarily in urban areas. This convenience is enhancing accessibility, particularly for individuals with chronic illnesses and the elderly population.

Growing use in corporate and preventive health programs:

Comprehensive metabolic panel testing is gaining prominence in preventive healthcare packages offered by wellness centers and employers. As part of annual checkups, these tests help detect organ and metabolic issues early. The corporate industry's emphasis on employee health is driving the adoption of routine comprehensive medical plans (CMPs).

The global comprehensive metabolic panel testing market is segmented as follows:

By Test Type

- Glucose

- Calcium

- Electrolytes

- Kidney Function Tests

- Liver Function Tests

- Proteins

By Disease Indication

- Kidney Diseases

- Liver Diseases

- Diabetes

- Others

By End User

- Point Of Care Centers

- Diagnostic Laboratories

- Hospitals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A comprehensive metabolic panel test is a routine blood test that provides crucial information on the body's metabolism and potential chemical imbalances. It measures 14 different elements in the blood, including calcium, glucose, indicators of kidney and liver function, and electrolytes. These tests are primarily used for diagnosing conditions, monitoring ongoing treatment, and assessing overall health status.

The global comprehensive metabolic panel testing market is projected to grow due to the increasing geriatric population, advancements in laboratory testing, and rising integration with Electronic Health Records (EHRs).

According to study, the global comprehensive metabolic panel testing market size was worth around USD 12.58 billion in 2024 and is predicted to grow to around USD 26.00 billion by 2034.

The CAGR value of the comprehensive metabolic panel testing market is expected to be approximately 9.50% from 2025 to 2034.

Which region will contribute notably towards the comprehensive metabolic panel testing market value?

North America is expected to lead the global comprehensive metabolic panel testing market during the forecast period.

The key players profiled in the global comprehensive metabolic panel testing market include Abbott Laboratories, F. Hoffmann-La Roche Ltd, Siemens Healthineers, Thermo Fisher Scientific Inc., Danaher Corporation, Bio-Rad Laboratories, Inc., Beckman Coulter, Inc., Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (Labcorp), Becton, Dickinson and Company (BD), PerkinElmer, Inc., BioMérieux SA, Ortho Clinical Diagnostics, Randox Laboratories Ltd., and Nova Biomedical.

The report examines key aspects of the comprehensive metabolic panel testing market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

List of Contents

Comprehensive Metabolic Panel TestingIndustry Perspective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisCompetitive AnalysisKey Market TrendsThe global comprehensive metabolic panel testing market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed