Aseptic Packaging Market Size, Share, Trends, Growth 2034

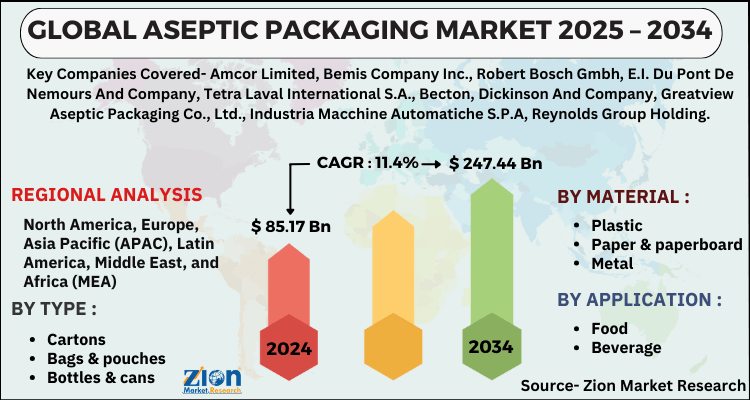

Aseptic Packaging Market By Type (Cartons, Bags & pouches, Bottles & cans, Ampoules and Others (bag-in-box packaging, cups, trays, and containers)), By Material (Plastic, Paper & paperboard, Metal, Glass and Wood), By Application (Food, Beverage, Pharmaceutical and Others) and By Region - Global Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecasts 2025 - 2034

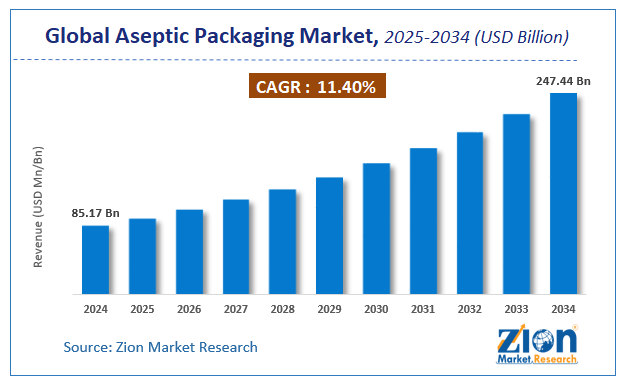

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 85.17 Billion | USD 247.44 Billion | 11.4% | 2024 |

Global Aseptic Packaging Market Industry Perspective:

The global Aseptic Packaging market was worth around USD 85.17 Billion in 2024 and is estimated to grow to about USD 247.44 Billion by 2034, with a compound annual growth rate (CAGR) of roughly 11.4% between 2025 and 2034. The report analyzes the Aseptic Packaging market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Aseptic Packaging market.

Global Aseptic Packaging Market: Overview

In Global Aseptic Packaging Market Report, Aseptic packaging is a method of preventing virus and bacteria contamination by packing a beverage or food product at ultra-high temperatures (UHT), sterilizing or disinfecting its package discretely, and then fusing and sealing it under sterilized atmospheric conditions. Plastic, glass, paperboard, and metal are used to make cans, containers, cartons, and various aseptic products. The use of aseptic packing increases the shelf life of packaged goods. It is also environmentally beneficial. Furthermore, it preserves the integrity of the contents packed inside and does not require preservatives, making it a boon to the worldwide aseptic packaging industry. Governments from all over the world have boosted their spending on healthcare.

Similarly, in recent years, the reuse and recycling of packaging materials have received a lot of attention. For both functional and economic reasons, plastics play a major role in the packaging business. These are some of the primary aspects that are driving the aseptic packaging market forward. Consumer desires for more hygienic and safe packaging of ready-to-eat food items are driving demand for aseptically packaged products.

Key Insights

- As per the analysis shared by our research analyst, the global aseptic packaging market is estimated to grow annually at a CAGR of around 11.4% over the forecast period (2025-2034).

- Regarding revenue, the global aseptic packaging market size was valued at around USD 85.17 Billion in 2024 and is projected to reach USD 247.44 Billion by 2034.

- The aseptic packaging market is projected to grow at a significant rate due to increasing demand for longer shelf-life food and beverages, pharmaceutical packaging needs, and advancements in sterilization technologies.

- Based on Type, the Cartons segment is expected to lead the global market.

- On the basis of Material, the Plastic segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Food segment is projected to swipe the largest market share.

- Based on region, Europe is predicted to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Aseptic Packaging Market: Growth Drivers

Global Aseptic Packaging Market Drivers: Shift in consumer preference against the use of food preservatives

There is an increasing need for long-lasting convenience foods that are either bacterial-free or can delay bacterial infection. Food preservatives are widely used in the food industry to increase shelf life and maintain product quality. However, people are becoming more aware of the negative impact of eating processed meals laced with additives.

Restraint: Need for improved technological understanding than required for other packaging forms

Another stumbling block to the market's expansion is the technological know-how and skills necessary to set up a plant for aseptically packaging items. Establishing an aseptic packaging factory necessitates extensive expertise in this form of packaging and the end-use sector served, as it necessitates cautious handling at every step due to which manufacturers are discouraged from entering the aseptic packaging industry. This characteristic of aseptic packing creates a roadblock to market expansion.

Opportunities: Electronic logistics processing

Starting with raw material suppliers, manufacturers, and package users, and ending with retailers and consumers, electronic business processing connects the entire packaging supply chain. This results in more timely and accurate information, lower costs and time delays, simplified logistics and inventory operations, and a better response to customer requests. This will aid in increasing the product's delivery speed, which is critical for a business.

Challenges: Variations in environmental mandates across regions

Environmental restrictions governing the packaging sector differ from country to country, making it difficult for businesses to adapt to the packaging materials used in accordance with local requirements. Environmental regulations affect not only manufacturers, but also consumers, governments, and businesses.

Aseptic Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aseptic Packaging Market |

| Market Size in 2024 | USD 85.17 Billion |

| Market Forecast in 2034 | USD 247.44 Billion |

| Growth Rate | CAGR of 11.4% |

| Number of Pages | 168 |

| Key Companies Covered | Amcor Limited, Bemis Company Inc., Robert Bosch Gmbh, E.I. Du Pont De Nemours And Company, Tetra Laval International S.A., Becton, Dickinson And Company, Greatview Aseptic Packaging Co., Ltd., Industria Macchine Automatiche S.P.A, Reynolds Group Holding, , and others. |

| Segments Covered | By Type, By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Aseptic Packaging Market: Segmentation

The global Aseptic Packaging market is segregated based on Type, Material, and Application.

Based on type, the market is divided into Cartons, Bags & pouches, Bottles & cans, Ampoules, and Others (bag-in-box packaging, cups, trays, and containers). The bottles & cans segment is expected to increase at the fastest CAGR. The use of bottles and cans in the aseptic packaging industry is being driven by rising demand from the food and beverage packaging sectors.

The increased demand for beverages, particularly from the dairy and juice packaging markets, is attributable to the market's rise. The expansion of tinned meat, fish, and fruit items, as well as ready-to-serve marketplaces, has influenced the cans segment. To ensure that food is kept has a long shelf life, and remains fresh, cans are sealed with a double seam and are airtight and tamperproof.

Based on application, the market is segmented into Food, Beverage, Pharmaceutical, and Others. Aseptic packaging is thought to be most commonly used in the beverage industry. The aseptic packaging industry is being driven by consumer demand for convenience and high-quality food, as well as the growth of the dairy beverage sector. Emerging markets, such as the Asia-Pacific area, have aided in the adoption of aseptic packaging in the beverage industry. The aseptic packaging market is restrained by a high cost-to-benefit ratio for small firms and a high research and development investment.

Recent Developments

- In August 2021, Amcor established new innovation centers in other countries. Customers will be able to visit the new facilities in Ghent, Belgium, and Jiangyin, China, beginning in mid-2022, with full construction taking place over the next two years. The total investment is estimated to be around $35 million.

- In February 2021, Liquibox introduced Liquipure Ultra, a recyclable bag-in-box packaging specifically suited for applications with a medium to the high barrier. Liquibox is collaborating with clients to produce Liquipure ultra for higher-barrier applications like wine, and this product is currently available in the United States.

Aseptic Packaging Market: Regional Landscape

Due to the huge pharmaceutical production base and ability to provide technological breakthroughs to pharmaceutical packaging, the North American area is also one of the largest in the pharmaceutical sector. In the pharmaceutical, healthcare, and biotechnology industries, the United States has been one of the top R&D spenders.

The Asia Pacific is thought to hold the highest share of the global packaging market, and this trend is projected to continue in the coming years. The reason for such a continuous growth rate is that key firms are transferring their manufacturing bases to developing countries in the area, such as India and China, due to low production and labor costs.

Aseptic Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the aseptic packaging market on a global and regional basis.

Some of the main competitors dominating the global Aseptic Packaging market include –

- Amcor Limited

- Bemis Company, Inc.

- Robert Bosch Gmbh

- E.I. Du Pont De Nemours And Company

- Tetra Laval International S.A.

- Becton

- Dickinson And Company

- Greatview Aseptic Packaging Co.

- Ltd., Industria Macchine Automatiche S.P.A

- Reynolds Group Holding

- Schott Ag

- Ds Smith Plc.

The global Aseptic Packaging market is segmented as follows:

By Type

- Cartons

- Bags & pouches

- Bottles & cans

- Ampoules

- Others (bag-in-box packaging, cups, trays, and containers)

By Material

- Plastic

- Paper & paperboard

- Metal

- Glass

- Wood

By Application

- Food

- Beverage

- Pharmaceutical

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Aseptic packaging is a specialized technique used to preserve and package food, beverages, and pharmaceuticals in a sterile environment to ensure long shelf life without the need for refrigeration or preservatives

The global aseptic packaging market is expected to grow due to increasing demand for extended shelf-life products, growth in the food and beverage industry, and advancements in packaging technology.

According to a study, the global aseptic packaging market size was worth around USD 85.17 Billion in 2024 and is expected to reach USD 247.44 Billion by 2034.

The global aseptic packaging market is expected to grow at a CAGR of 11.4% during the forecast period.

Europe is expected to dominate the aseptic packaging market over the forecast period.

Leading players in the global aseptic packaging market include Amcor Limited, Bemis Company Inc., Robert Bosch Gmbh, E.I. Du Pont De Nemours And Company, Tetra Laval International S.A., Becton, Dickinson And Company, Greatview Aseptic Packaging Co., Ltd., Industria Macchine Automatiche S.P.A, Reynolds Group Holding, , among others.

The report explores crucial aspects of the aseptic packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Global Market Industry Perspective:OverviewKey InsightsGrowth DriversRestraint: Need for improved technological understanding than required for other packaging formsOpportunities: Electronic logistics processingChallenges: Variations in environmental mandates across regionsReport Scope SegmentationRecent DevelopmentsRegional LandscapeCompetitive AnalysisBy TypeBy MaterialRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed