Antifouling Paints and Coating Market Size, Share Report, Analysis, Trends, Growth 2032

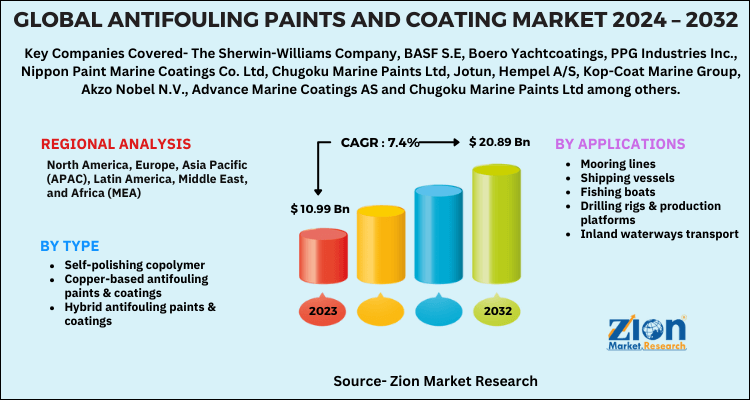

Antifouling Paints and Coating Market By Type (Self-polishing copolymer, Copper-based antifouling paints & coatings, Hybrid antifouling paints & coatings, and Others), By Application (Mooring lines, Shipping vessels, Fishing boats, Drilling rigs & production platforms, and Inland waterways transport): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.99 Billion | USD 20.89 Billion | 7.4% | 2023 |

Antifouling Paints and Coating Market Insights

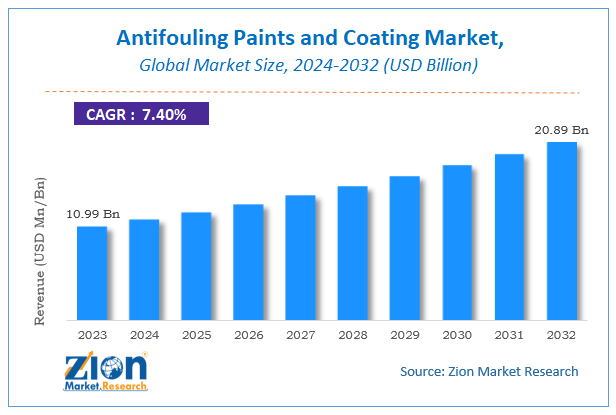

According to a report from Zion Market Research, the global Antifouling Paints and Coating Market was valued at USD 10.99 Billion in 2023 and is projected to hit USD 20.89 Billion by 2032, with a compound annual growth rate (CAGR) of 7.4% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Antifouling Paints and Coating Market industry over the next decade.

Antifouling Paints and Coating Market: Overview

Antifouling paints and coatings the coating used at the bottom of a ship or marine vessel to prevent or retard the degradation of the metallic surface that remains submerged. It helps to increase its longevity and efficiency of vessels. These marine paints are also useful for fixed and floating offshore oil rigs. High demand from the marine industry is likely to spur the market growth.

It also decreases fuel consumption, enhance durability, and enable compliance with environmental regulations. It is composed of cuprous oxides and biocides which inhibits growth of algae, barnacles and marine animals.

Antifouling Paints and Coating Market: Growth Factors

Antifouling paints and coatings market is boosted due to wide employment in offshore sector for coating the drilling rigs, shipping vessels, and mooring lines. Rising demand for antifouling paint and coating from the gas & oil sector is likely to boost the antifouling paints and coating market in the years to come. In addition to this, antifouling paints and coating market is bolstered due to superior characteristics such as fouling free. This eliminates external contamination and corrosion, which will help the development of antifouling paints and coating market in the years to come. On the other hand, high employment of antifouling paints and coating might cause adverse effect on the environment, thereby hindering the growth of antifouling paints and coating market. Nevertheless, in-progress research for launch of different coating methods is likely to boost the development of antifouling paints and coating market in the years to come. Furthermore, increasing demand from the up-and-coming nations and various end users such as gas & oil sector for the antifouling paints and coating market is expected to offer new avenues in the years to come.

Antifouling Paints and Coating Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Antifouling Paints and Coating Market |

| Market Size in 2023 | USD 10.99 Billion |

| Market Forecast in 2032 | USD 20.89 Billion |

| Growth Rate | CAGR of 7.4% |

| Number of Pages | 170 |

| Key Companies Covered | The Sherwin-Williams Company, BASF S.E, Boero Yachtcoatings, PPG Industries Inc., Nippon Paint Marine Coatings Co. Ltd, Chugoku Marine Paints Ltd, Jotun, Hempel A/S, Kop-Coat Marine Group, Akzo Nobel N.V., Advance Marine Coatings AS and Chugoku Marine Paints Ltd among others |

| Segments Covered | By Types, By Applications and By Region |

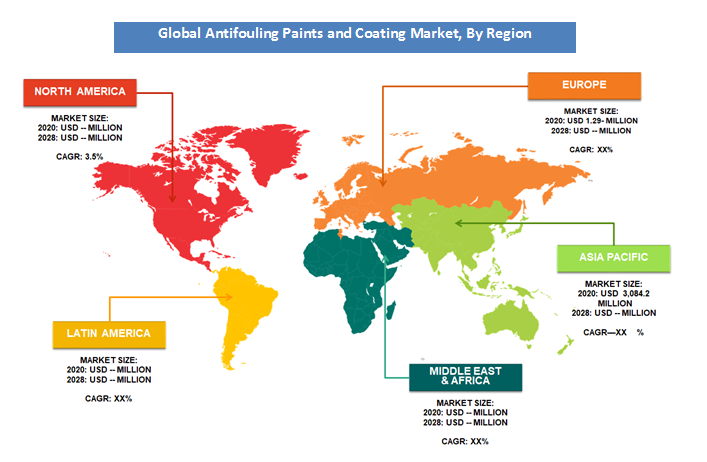

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Antifouling Paints and Coating Market: Segmentation

Segment Analysis Preview

Antifouling Paints and Coating finds wide applications in Mooring Lines, Shipping Vessels, Fishing Boats, Drilling Rigs & Production Platforms and Inland Waterways Transport. Mooring Lines witnessed a major CAGR in the market.

The shipping vessels application hold the major share and is likely to remain dominance throughout the forecast period. Antifouling is the process of protecting a ship’s hull with specifically designed materials, such as special paints and coatings that prevent these organisms from piling up in the hull.

Antifouling Paints and Coating Market: Competitive Landscape

The report present comprehensive competitive outlook with company profiles of the key players operating in the global market. Key participants profiled in the report include

- The Sherwin-Williams Company

- BASF S.E

- Boero Yachtcoatings

- PPG Industries Inc.

- Nippon Paint Marine Coatings Co. Ltd

- Chugoku Marine Paints Ltd

- Jotun

- Hempel A/S

- Kop-Coat Marine Group

- Akzo Nobel N.V.

- Advance Marine Coatings AS and Chugoku Marine Paints Ltd

- among others.

The global Antifouling Paints and Coating Market is segmented as follows:

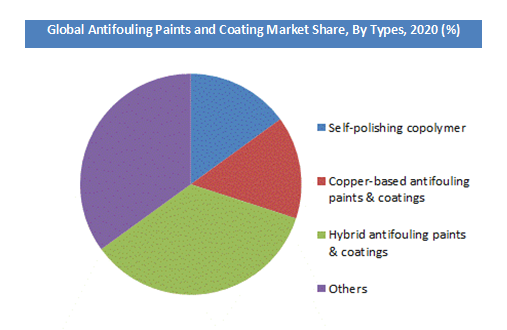

By Types

- Self-polishing copolymer

- Copper-based antifouling paints & coatings

- Hybrid antifouling paints & coatings

- Others

By Applications

- Mooring lines

- Shipping vessels

- Fishing boats

- Drilling rigs & production platforms

- Inland waterways transport

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global Antifouling Paints and Coating Market was valued at USD 10.99 Billion in 2023.

The Global Antifouling Paints and Coating Market is expected to reach USD 20.89 Billion by 2032, growing at a CAGR of 7.4% between 2024 to 2032.

Some of the key factors driving the Global Antifouling Paints and Coating Market growth are Rising demand for antifouling paint and coating from the gas & oil sector.

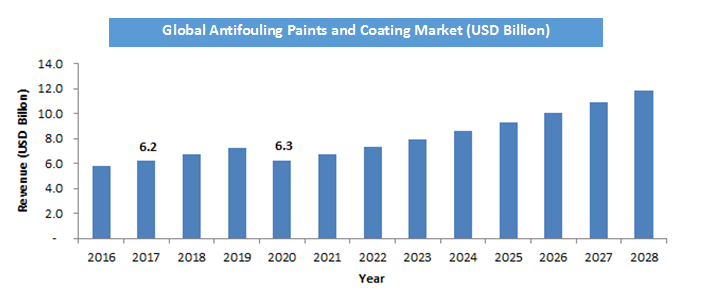

Asia Pacific in 2020 ruled the antifouling paints and coating market and was believed to be the highest income generating area all over the globe. Asia Pacific added up for almost 72% of the total share in antifouling paints and coating market in 2020. This was majorly owing to the rapidly developing shipbuilding sector in Taiwan, Japan, the Philippines, China, and Korea.

Some of the major players of Global Antifouling Paints and Coating market includes BASF S.E, The Sherwin-Williams Company, PPG Industries Inc., Boero Yachtcoatings, Chugoku Marine Paints Ltd, Nippon Paint Marine Coatings Co. Ltd, Kop-Coat Marine Group, Jotun, Hempel A/S, Advance Marine Coatings AS, Akzo Nobel N.V., and Chugoku Marine Paints Ltd among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed