Global Automotive Alloys Market To Grow At A CAGR Of 6.2% By 2034

18-Jul-2025 | Zion Market Research

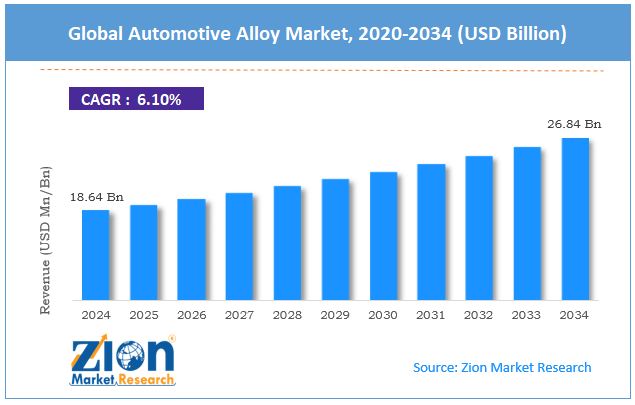

The global automotive alloys market size was worth around USD 18.64 billion in 2024 and is predicted to grow to around USD 26.84 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.1% between 2025 and 2034.

The automotive alloys sector encompasses the global industry of alloys used in the manufacturing of automobiles. These alloys are specifically engineered to meet the stringent requirements of the automotive sector, offering enhanced performance, durability, and lightweight characteristics. The market is driven by the growing demand for fuel-efficient and eco-friendly vehicles, as well as the increasing adoption of electric and hybrid vehicles. Automotive alloys are used in various components, including engine blocks, wheels, transmissions, and body structures, due to their excellent strength-to-weight ratio and corrosion resistance properties.

Browse the full “Automotive Alloy Market by Alloys Type (Steel, Aluminum, Magnesium, and Others), Vehicle Type (Passenger Car, LCV and HCV), Area of Application (Structural, Powertrain, Exterior and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034”- Report at https://www.zionmarketresearch.com/report/automotive-alloy-market

The increasing adoption of electric and hybrid vehicles has a positive impact on the automotive alloys market. These vehicles require lightweight materials to improve fuel efficiency and overall performance. Automotive alloys, such as aluminum and magnesium alloys, offer significant weight reduction while maintaining structural integrity. This enables manufacturers to meet the stringent fuel economy and emissions regulations imposed by governments worldwide. Additionally, the demand for electric vehicles is growing due to environmental concerns and government incentives. As a result, there is an escalating need for automotive alloys to meet the rising production of electric and hybrid vehicles. This trend is driving the growth of the automotive alloys industry as more manufacturers incorporate these alloys into their vehicle designs.

Automotive Alloy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Alloy Market |

| Market Size in 2024 | USD 18.64 Billion |

| Market Forecast in 2034 | USD 26.84 Billion |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 212 |

| Key Companies Covered | Constellium, AMG Advanced Metallurgical Group N.V., KOBE STEEL LTD, Novelis Inc., UACJ Corporation, ArcelorMittal S.A., Nippon Steel & Sumitomo Metal Corporation, Norsk Hydro ASA, Thyssenkrupp AG, Alcoa Corporation, and others. |

| Segments Covered | By Alloy Type, By Vehicle Type, By Area of Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The global automotive alloys market is segmented based on alloy type, vehicle type, area of application, and region.

The market comprises various alloy types, including steel, aluminum, magnesium, and others. Of these, Aluminum alloys hold the largest market share due to their lightweight properties, which help reduce vehicle weight and enhance fuel efficiency. They are widely used in components like body panels, chassis, wheels, and engine parts. Steel alloys also have a significant market share, valued for their strength and cost-effectiveness in structural components. Magnesium alloys face challenges of higher costs and limited availability, resulting in a smaller market share. Other alloys like titanium and composites have niche applications in high-performance or luxury vehicles, with a relatively smaller market share compared to steel and aluminum.

Based on the area of application, the market is segregated into structural, powertrain, exterior, and others.

Based on vehicle type, the automotive alloys industry is segmented into passenger car, LCV, and HCV. Of these, passenger cars have the largest market share. They have high demand due to their large production volume and consumer appeal. Automotive alloys are extensively used in passenger cars to improve fuel efficiency, enhance safety, and reduce weight. Light commercial vehicles (LCVs) have a smaller market share, requiring durable alloys to withstand heavy loads and rough terrains. Heavy commercial vehicles (HCVs) also have a smaller market share, but they utilize specialized alloys for their heavy-duty applications. Passenger cars dominate the market, followed by LCVs and HCVs.

Regionally, the Asia Pacific is the dominant region in the global automotive alloys market due to several key factors. The region is home to some of the world's largest automotive manufacturers and has a strong presence in the automotive industry. The growing demand for vehicles in countries like China, India, Japan, and South Korea has fueled the need for automotive alloys.

Additionally, Asia Pacific has a robust manufacturing infrastructure and supply chain network, allowing for efficient production and distribution of automotive alloys. The region also benefits from favorable government policies and initiatives promoting the adoption of lightweight materials for improved fuel efficiency and reduced emissions. Moreover, the presence of a large consumer base, rapid urbanization, and increasing disposable incomes contribute to the growth of the automotive sector, further driving the demand for automotive alloys in the Asia Pacific region.

The major players operating in the Automotive Alloys market include:

- Constellium

- AMG Advanced Metallurgical Group N.V.

- KOBE STEEL LTD

- Novelis Inc.

- UACJ Corporation

- ArcelorMittal S.A.

- Nippon Steel & Sumitomo Metal Corporation

- Norsk Hydro ASA

- Thyssenkrupp AG

- Alcoa Corporation

Recent Development:

- March 2022 - The Ronal Group has introduced the Ronal R67, a newly developed wheel design for application in automotive vehicles. This innovative wheel features a combination of five distinct double spokes and five narrow spokes, resulting in an aesthetically appealing design. The incorporation of vibrant design elements adds a touch of vibrancy to the overall appearance. Furthermore, the inclusion of aero-style applications in either Tornado Red or Track Grey (anthracite) enhances the wheel's sporty character while ensuring optimal air intake. The Ronal R67 wheel design not only offers a visually appealing option but also delivers an ideal blend of style and performance.

- July 2022 - Alcoa Corporation has recently made an announcement regarding the operational challenges it is facing. As a result, the company has initiated the immediate process of shutting down one of its three operating smelting lines at the Warrick Operations facility located in Indiana. The decision has been made in response to the difficulties encountered during operations, and Alcoa Corporation is taking necessary steps to address these challenges efficiently.

- Meridian Lightweight Technologies developed its MgRE20 magnesium alloy in August 2023, incorporating rare-earth elements to improve corrosion resistance. BMW has adopted this advanced magnesium alloy for seat frames in its i7 luxury electric sedan to reduce weight without compromising durability.

- In March 2024, Norsk Hydro introduced Hydro CIRCAL 100R, the world's first commercially available 100% recycled automotive aluminum with a carbon footprint of just 6 kg CO₂ per kg of material. Mercedes-Benz has already adopted this for its EQXX concept vehicle to reduce lifecycle emissions.

- ArcelorMittal unveiled Usibor® 2000 in February 2024, currently the world's strongest automotive steel with 2GPa tensile strength. Ford has implemented this in the F-150 Lightning's battery protection system to enhance safety while minimizing weight.

The global automotive alloy market is segmented as follows:

By Alloy Type

- Steel

- Aluminum

- Magnesium

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Area of Application

- Structural

- Powertrain

- Exterior

- Others

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed