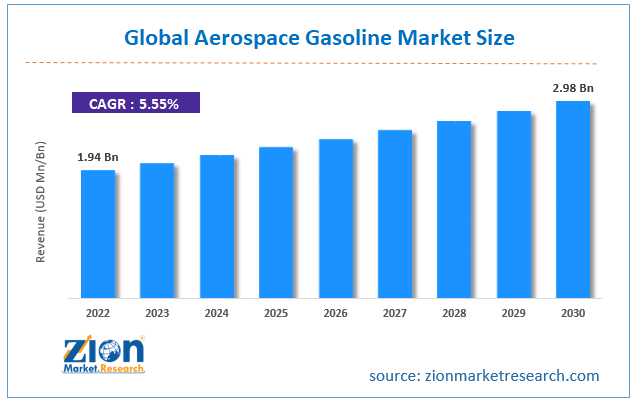

Global Aerospace Gasoline Market To Grow At A CAGR Of 5.55% During The Forecast Period

21-Jun-2023 | Zion Market Research

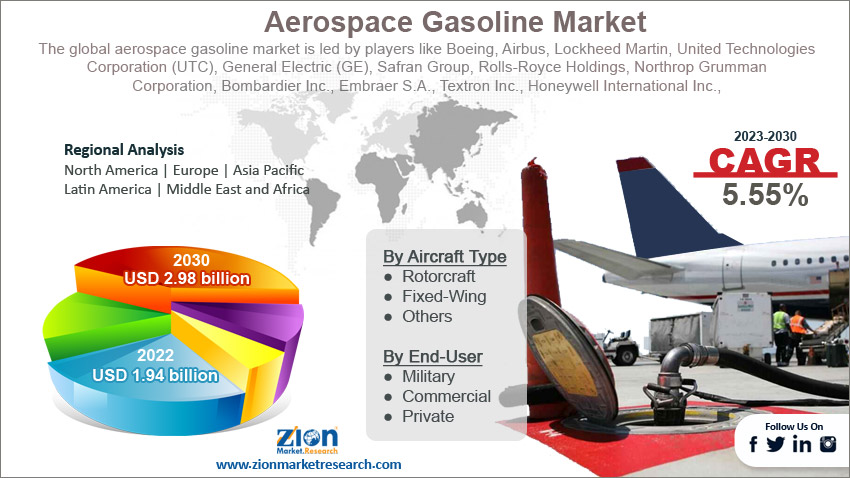

The global aerospace gasoline market size was worth around USD 1.94 billion in 2022 and is predicted to grow to around USD 2.98 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.55% between 2023 and 2030.

The aerospace gasoline market refers to the production, purchase, and sale of aviation gas, also known as avgas. It is a specialized type of fuel used in piston-engine aircraft. The size of the industry depends on factors such as the number of piston-engine aircraft in operations along with regional demand and general aviation activities within a country or across international borders. In recent times, multiple factors have greatly influenced the aerospace gasoline industry growth trajectory and in the future, market players are expected to come across better growth avenues. A piston-engine aircraft is powered by piston engines and works on the principles of reciprocating motion. In this technique, the piston moves up and down within a cylinder to generate power.

This review is based on a report by Zion Market Research, titled "Aerospace Gasoline Market By Fuel Type (Avgas 100, Avgas UL94, Avgas 100LL, Avgas 115, Avgas UL91, Avgas 80, And Others), By Aircraft Type (Rotorcraft, Fixed-Wing, And Others), By End-User (Military, Commercial, And Private), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 – 2030"- Report at https://www.zionmarketresearch.com/report/aerospace-gasoline-market

The global aerospace gasoline market is expected to grow owing to the expansion of aircraft fleets across the globe. This is particularly related to piston-engine aircraft. For instance, as per the Massachusetts Institute of Technology (MIT), the United States has more than 67,000 piston-engine aircraft and these planes hold the majority share of the regional general aviation sector. Furthermore, the growing number of flight training programs worldwide could lead to higher demand for avgas as it becomes an essential component to power an aircraft for aspiring pilots to undergo training. With the expanding aviation sector, there is a surging need for well-trained and proficient pilots that can maneuver a flight even in difficult situations and across geographical locations.

Another crucial point of growth may be seen in the growing infrastructure development projects undertaken by developing and developed nations. Every country is working toward deploying more efficient aircraft carriers. This includes consistent research & development along with strategic partnerships to innovate and run trials of new forms of sustainable avgas. Moreover, as the general aviation sector expands, the need and use of avgas are projected to grow at a steady rate.

However, the global aerospace gasoline industry may also come across certain growth restrictions due to challenging environmental and regulatory compliances. The trend could be strengthened by the impact of the use of gasoline on the ecosystem leading to greater adoption of electric or hybrid small aircraft. Rapid technological advancements in the aviation sector are likely to impact the demand for aerospace gasoline since the world is eyeing the development of fuel-efficient engines that use electric or hybrid propulsion systems. Other factors such as infrastructure limitations and volatile fuel prices could also impede industry growth.

Modernization and upgrades may provide growth opportunities while the relatively less commercial airway traffic could challenge market expansion.

The global aerospace gasoline market is segmented based on fuel type, aircraft type, end-user, and region.

Based on fuel type, the global market segments are avgas 100, avgas UL94, avgas 100LL, avgas 115, avgas UL91, avgas 80, and others.

Based on aircraft type, the global aerospace gasoline industry is segmented into rotorcraft, fixed-wing, and others. Leading with over 63.2% of the global share, the fixed-wing segment was the largest contributor in 2022. For operational purposes, fixed-wing aircraft make use of turbine engines and pistons. Since aerospace gasoline is most suitable for turbine engines, segmental growth is automatically a byproduct of the transaction. Since this type of aircraft tends to be heavy and generally covers long distances, gasoline is considered ideal when compared to electric or hybrid fuels. They have applications across military and commercial markets.

Based on end-user, the global aerospace gasoline industry is segmented into military, commercial, and private. The industry witnessed the highest growth in the private segment with dominance over 58.1% of the global share. This was primarily due to the increased spending on private airplanes by companies and individuals. In recent times, the number of companies offering private chartered flights for tourism, business, air sports, and commercial purposes has grown at a rapid rate. Primarily reasons such as increased income, changing lifestyle, and easier access to private services have led to the high demand in this segment. The commercial section may also generate a high growth rate as there may be a demand for commercial flights to handle growing emergency incidents across the globe.

The global aerospace gasoline market is projected to be dominated by North America due to the presence of key manufacturers of piston-engine aircraft and the growing use of these carriers for business, commercial, and military purposes. The US military and government use such aircraft for surveillance purposes as well as it has numerous takers in the private segment. Favorable regulatory conditions have also contributed to the industry's growth trajectory.

Europe is a significant player in the industry with Germany, UK, and France leading with the highest regional market share. France is a dominant exporter of aviation entities such as piston-engine aircraft to other countries. There is high domestic demand as well.

Growing economies such as China, India, and the increasing expenditure by South Korea, Japan, and Singapore in upgrading the aviation sector could assist Asia-Pacific to generate higher growth.

Recent Developments:

- In April 2023, Air India signed an agreement with KSU Aviation with the goal to launch TaxiBot operations at Bengaluru and Delhi airports in India. This move is expected to help India save nearly 15,000 tonnes of jet fuel in the next 3 years

- In April 2023, LanzaJet, a US-based firm, and Indian Oil entered a partnership that will work toward setting up the country’s first green aviation fuel plant. The refinery is expected to be worth INR 3,000 crore

- In March 2023, Honeywell announced the introduction of UOP EFining™ Technology which will be used to develop a new class of Sustainable Aviation Fuel (SAF)

Aerospace Gasoline Market: Competitive Analysis

The global aerospace gasoline market is led by players like:

- Boeing

- Airbus

- Lockheed Martin

- United Technologies Corporation (UTC)

- General Electric (GE)

- Safran Group

- Rolls-Royce Holdings

- Northrop Grumman Corporation

- Bombardier Inc.

- Embraer S.A.

- Textron Inc.

- Honeywell International Inc.

- Leonardo S.p.A.

- Raytheon Technologies Corporation

- BAE Systems

- Pratt & Whitney (division of Raytheon Technologies)

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Thales Group

- Spirit AeroSystems Holdings Inc.

- General Dynamics Corporation

- Dassault Aviation

- Bell Textron Inc. (a Textron Inc. company)

- L3 Harris Technologies

- Meggitt PLC.

The global aerospace gasoline market is segmented as follows:

By Fuel Type

- Avgas 100

- Avgas UL94

- Avgas 100LL

- Avgas 115

- Avgas UL91

- Avgas 80

- Others

By Aircraft Type

- Rotorcraft

- Fixed-Wing

- Others

By End-User

- Military

- Commercial

- Private

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed